Introduction:

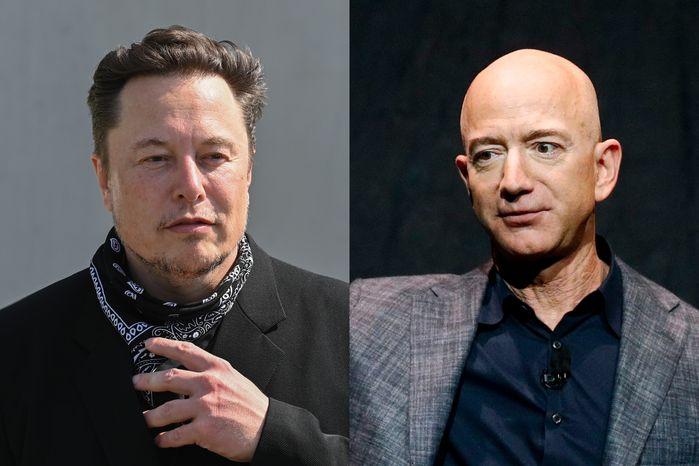

In the aftermath of a groundbreaking court ruling concerning Elon Musk pay package at Tesla, Lawyers Seek Nearly $6 Billion are embroiled in a contentious battle over nearly $6 billion in fees. This blog explores the intricacies of this legal saga, shedding light on the implications for Tesla, Musk, and the legal landscape at large.

Table of Contents

1. Background of Elon Musk’s Pay Package:

Elon Musk’s 2018 compensation package for Tesla was indeed record-breaking and quite controversial. Here’s a breakdown of the background and key points:

Structure of the Package:

- Stock Options: The package offered Musk 12 tranches of stock options, each representing 1% of Tesla’s outstanding shares at the time (around 304 million options total).

- Performance-Based: These options would only vest if Tesla achieved a series of ambitious performance goals. These goals were tied to:

- Market Capitalization: Increasing Tesla’s market cap by $50 billion increments, reaching a total of $650 billion within 10 years.

- Revenue and EBITDA Growth: Achieving aggressive targets for both revenue and earnings before interest, taxes, depreciation, and amortization (EBITDA).

Outcomes:

- Tesla’s Growth: By 2023, Tesla had achieved all 12 performance targets, experiencing significant growth in market capitalization and financial performance.

- Value of Options: As a result, Musk’s options became valuable, with estimates suggesting a total worth of around $51 billion (after considering the cost to exercise them). This made him the highest-paid CEO in the US.

Controversy and Court Case:

- Excessive Compensation: The sheer size of the package raised concerns about executive compensation and fairness to shareholders.

- Lack of Independence: A Delaware judge ruled in 2024 that the board’s approval process for the package was flawed due to a lack of independence from Musk’s influence.

- Court Decision: The judge struck down the entire package, meaning Musk did not receive the options.

Current Situation:

- Appeal: As of March 5, 2024, it’s unclear if Musk will appeal the court’s decision.

Overall, Elon Musk’s 2018 compensation package was a bold attempt to link executive pay to company performance. However, its size and potential conflicts of interest led to legal challenges and ultimately its cancellation.

Also Read – The Ultimate Guide to Google My Business Directory: Boost Your Online Presence

Also Read – 10 Proven Strategies to Boost Your LinkedIn Profile Visibility

2. Legal Proceedings and Court Ruling:

The legal battle surrounding Elon Musk’s 2018 compensation package involved several key stages and culminated in a controversial court ruling:

1. Shareholder Lawsuit:

- In 2020, a Tesla shareholder filed a lawsuit challenging the board’s approval of Musk’s compensation package.

- The lawsuit argued that the package was excessive and unfair to shareholders for several reasons:

- Size: The potential value of the options was deemed exorbitant.

- Lack of Transparency: The approval process was criticized for being opaque and lacking independent oversight.

- Conflicts of Interest: Concerns were raised about the board’s independence in light of Musk’s significant influence over the company.

2. Court Challenges:

- The lawsuit went through the Delaware court system, which oversees many corporate disputes due to its business-friendly environment.

- During the legal proceedings, arguments centered on:

- Performance-based justification: Tesla’s lawyers argued the package was linked to ambitious performance goals and ultimately benefitted shareholders through Tesla’s growth.

- Board’s rationale and fairness: The defendants argued the board followed a fair process and considered Musk’s role in driving Tesla’s success.

3. Court’s Decision:

- In January 2024, the Delaware Court of Chancery, a specialized court for business disputes, ruled in favor of the plaintiff shareholder.

- The judge determined that the board’s approval process was flawed due to:

- Conflicts of interest: The board failed to sufficiently address potential conflicts arising from Musk’s influence.

- Inadequate deliberation: The board’s consideration of the package was deemed insufficient and lacking in independence.

- Ruling: As a consequence, the judge rescinded the entire compensation package. This meant Musk did not receive the stock options and their potential value.

4. Current Status:

- As of March 5, 2024, it is unknown whether Musk will appeal the court’s decision.

- The ruling has sparked broader discussions about executive compensation, board accountability, and conflicts of interest.

Overall, the legal process surrounding Elon Musk’s pay package highlighted the complexities of executive compensation and the importance of fair and transparent governance in corporations.

3. Lawyers’ Pursuit of Fees:

The pursuit of fees by lawyers is a complex and multifaceted issue with both ethical and practical considerations. Here’s a breakdown of some key points:

Fee Structure:

- Hourly Billing: Traditionally, lawyers have charged fees based on the number of hours they work on a case. This method incentivizes efficiency, but it can also lead to concerns about high costs for clients, especially in protracted cases.

- Contingent Fees: In some cases, lawyers work on a contingency fee basis, where their fee is a percentage of the client’s recovery, typically ranging from 25% to 40%. This can incentivize lawyers to fight for the best possible outcome for their clients, as their own pay depends on success. However, it can also lead to cases being rejected if the lawyer doesn’t believe there’s a strong chance of winning and receiving a fee.

- Fixed Fees: In some situations, lawyers may agree to a fixed fee upfront for a specific service, such as drafting a legal document. This provides certainty for the client regarding costs, but it may not be suitable for complex or unpredictable cases.

Ethical Considerations:

- Professional Responsibility: Lawyers are bound by ethical codes that require them to act in the best interests of their clients and avoid conflicts of interest. This includes ensuring that their fees are reasonable and not excessive.

- Transparency: Lawyers are required to be transparent with their clients about their fee structure, the estimated costs of legal representation, and any potential conflicts of interest.

Criticisms of Fee Structures:

- High Costs: Critics argue that the current fee structure can make legal representation prohibitively expensive for many individuals and small businesses, hindering access to justice.

- Focus on Profit: Some argue that the pursuit of high fees can incentivize lawyers to prioritize profitability over their client’s best interests, leading to unnecessary litigation or overcharging.

Potential Solutions:

- Alternative Fee Arrangements: Exploring alternative fee arrangements, like blended hourly rates or capped fees, can offer greater flexibility and cost predictability for clients.

- Technology Integration: Utilizing technological tools and automation can streamline legal work and potentially reduce costs for both lawyers and clients.

- Pro Bono Work: Encouraging lawyers to dedicate a portion of their time to pro bono work can help ensure access to legal services for those who cannot afford them.

Overall, the pursuit of fees by lawyers is a complex issue with no easy solutions. It’s essential to maintain a balance between ensuring fair compensation for legal services and guaranteeing reasonable access to justice for all.

4. Implications for Tesla and Elon Musk:

The legal battle and court ruling surrounding Elon Musk’s 2018 compensation package have significant implications for both Tesla and Elon Musk himself. Here’s a breakdown of the potential consequences:

For Tesla:

- Reputational Damage: The controversy surrounding the pay package has cast a shadow over Tesla’s corporate governance practices. Investors and stakeholders may question the board’s independence and its ability to act in the best interests of shareholders.

- Scrutiny of Executive Compensation: The case may lead to increased scrutiny of executive compensation practices at Tesla, potentially sparking debates about pay structures and alignment with company performance.

- Potential for Shareholder Lawsuits: The court’s decision could embolden other shareholders to pursue similar lawsuits against Tesla’s board regarding future executive compensation packages.

- Impact on Investor Confidence: The legal battle and its outcome could affect investor confidence in Tesla’s leadership and governance, potentially impacting the company’s stock price.

For Elon Musk:

- Financial Loss: Musk loses out on the potential windfall of the stock options, estimated to be worth billions of dollars.

- Reputational Hit: The controversy could dent Musk’s image as a visionary leader and raise concerns about his influence over Tesla’s governance.

- Potential for Further Scrutiny: The legal battle may lead to increased regulatory scrutiny of Musk’s business dealings and potential conflicts of interest.

- Impact on Leadership Credibility: The court’s ruling could undermine Musk’s credibility as a leader who can navigate complex corporate governance issues.

Uncertainties and Potential Developments:

- The appeal of the Decision: It’s unclear if Musk will appeal the court’s decision, which could prolong the legal battle and its associated uncertainties.

- Changes to Board Composition: The court’s ruling might prompt changes to Tesla’s board composition to ensure greater independence and stronger oversight of executive compensation.

- Impact on Future Compensation: Tesla’s board will need to carefully consider how to structure future executive compensation packages to ensure alignment with shareholder interests while incentivizing performance.

Overall, the legal battle surrounding Elon Musk’s pay package has significant ramifications for both Tesla and Musk. The outcome highlights the importance of responsible corporate governance, transparency, and fair treatment of shareholders.

5. Public Perception and Investor Reaction:

The legal battle surrounding Elon Musk’s 2018 compensation package and the subsequent court ruling have generated significant public and investor reactions, with mixed opinions and potential consequences for both Tesla and Musk.

Public Perception:

- Support for Shareholders: Many individuals view the court’s decision as a victory for shareholders and corporate accountability. They believe the original compensation package was excessive and unfair, and the ruling sends a message that boards need to prioritize shareholder interests.

- Concerns over Musk’s Leadership: The controversy has raised concerns about Musk’s leadership style and potential conflicts of interest. Some view him as too powerful and influential within Tesla, potentially hindering good corporate governance practices.

- Defense of Musk: Some individuals, particularly Tesla fans and those who admire Musk’s entrepreneurial spirit, defend the original package and criticize the court’s decision. They argue that Musk’s vision and leadership were crucial to Tesla’s success, and the compensation package was justified as a way to incentivize his performance.

Investor Reaction:

- Short-Term Volatility: The lawsuit and court ruling might have contributed to short-term volatility in Tesla’s stock price as investors grappled with the uncertainties and potential implications.

- Focus on Governance: The case has brought increased scrutiny to Tesla’s corporate governance practices. Investors may be more cautious and pay closer attention to future executive compensation decisions and board composition.

- Long-Term Impact: The long-term impact on Tesla’s stock price and investor confidence will likely depend on several factors, including the company’s future financial performance, Musk’s leadership, and the effectiveness of Tesla’s board in addressing governance concerns.

Overall, public perception and investor reaction to the case are diverse and complex. While some support the court’s decision and view it as a win for accountability, others defend Musk and remain concerned about potential long-term impacts on Tesla.

It’s important to note that these are just potential consequences and reactions, and the full extent of the impact will unfold over time. The situation remains fluid, and further developments, such as potential appeals or changes within Tesla, could alter the landscape.

6. Legal Precedents and Future Implications:

The legal battle surrounding Elon Musk’s 2018 compensation package has the potential to set legal precedents and have future implications for various stakeholders, including:

Potential Legal Precedents:

- Board Independence and Oversight: The court’s emphasis on the board’s lack of independence and inadequate deliberation could set a precedent for stricter scrutiny of board processes when approving executive compensation packages. This could lead to:

- Increased scrutiny of potential conflicts of interest between executives and board members.

- Greater emphasis on independent directors and involvement of compensation committees with no conflicts.

- Enhanced board oversight and justification for executive compensation decisions.

- Fairness and Transparency: The case highlights the importance of fairness and transparency in executive compensation. Courts might be more inclined to review similar cases and assess:

- Alignment of compensation with company performance and shareholder interests.

- Transparency in the board’s decision-making process and rationale for compensation packages.

- Disclosure of potential conflicts of interest and steps taken to mitigate them.

Future Implications:

- For boards of directors: Increased focus on strengthening board governance practices, particularly regarding executive compensation decisions. Boards might need to:

- Implement stricter conflict-of-interest policies and procedures.

- Ensure independent directors participate fully in compensation discussions.

- Provide clear and detailed justifications for executive compensation packages.

- For executive compensation practices: Potential shift towards more structured and performance-based compensation plans with clear metrics and alignment with shareholder value. This could involve:

- Greater use of performance-based stock options and other variable pay components.

- Closer scrutiny of “mega-grants” and excessively large compensation packages.

- Increased focus on long-term shareholder value creation rather than short-term gains.

- For shareholders: The case could empower shareholders to more actively engage with companies regarding executive compensation, potentially leading to:

- Increased shareholder activism and proxy advisory firm involvement in compensation matters.

- Greater pressure on companies to justify executive pay and demonstrate alignment with shareholder interests.

Uncertainties and Considerations:

- Appeal of the decision: If Musk appeals the court’s ruling, it could delay the outcome and potentially change the legal landscape.

- Specific case vs. broader implications: While the case may set precedents, it’s important to remember that each case has its unique facts and circumstances. Courts will continue to analyze future cases based on their specific merits.

- Industry and company-specific factors: The impact on different industries and companies will likely vary depending on their specific governance practices, compensation structures, and shareholder dynamics.

Overall, the legal battle surrounding Elon Musk’s compensation package has the potential to influence future corporate governance practices, executive compensation structures, and shareholder engagement. However, the full extent of its implications will likely become clearer in the years to come, depending on potential appeals, future court rulings, and evolving industry practices.

7. Potential Resolutions and Next Steps:

Following the legal battle and court ruling surrounding Elon Musk’s 2018 compensation package, several potential resolutions and next steps could unfold, impacting both Tesla and the broader corporate landscape.

For Tesla:

- Appeal the Decision: Musk has the option to appeal the court’s decision, potentially delaying the outcome and extending the legal battle. This path, however, could be costly and time-consuming, further impacting Tesla’s reputation and potentially delaying any closure for the company and its shareholders.

- Revise Compensation Package: Tesla’s board could choose to redesign Musk’s compensation package, addressing the court’s concerns about fairness, transparency, and board independence. This would involve:

- Ensuring a more balanced and performance-based structure.

- Addressing potential conflicts of interest and demonstrating stronger board oversight.

- Providing clear and transparent justification for the revised package.

- Focus on Improved Governance: Tesla could take proactive steps to strengthen its corporate governance practices, potentially including:

- Appointing additional independent directors to the board.

- Enhancing board training and education on best practices in executive compensation.

- Implementing stricter conflict-of-interest policies and procedures.

For Elon Musk:

- Accept the Decision: Musk could accept the court’s ruling, forfeiting the potential windfall of the stock options. This path might bring closure to the legal battle but could also have financial and reputational implications for him.

- Negotiate a New Package: Musk could potentially negotiate a new compensation package with Tesla’s board, considering the court’s concerns and focusing on a more balanced and justifiable structure.

- Focus on Future Endeavors: While the legal battle may have implications for Musk’s leadership image, he could choose to focus on his other ventures and future endeavors, potentially mitigating the long-term impact.

Broader Implications:

- Impact on Corporate Governance: The case has sparked discussions about the importance of strong corporate governance, particularly regarding executive compensation. This could lead to increased scrutiny of board practices and calls for greater transparency and fairness in compensation decisions across various companies.

- Potential for New Regulations: Depending on the case’s long-term impact and broader discussions, regulatory bodies might consider introducing stricter regulations or guidance regarding executive compensation practices.

- Increased Shareholder Activism: The case could embolden shareholders to be more vocal and active in holding companies accountable for executive compensation decisions, potentially leading to increased engagement and proxy fights.

Uncertainties and Future Developments:

The full picture regarding the case’s long-term implications and next steps remains unclear. Key factors like potential appeals, future court rulings, and evolving industry practices will play a role in shaping the ultimate outcomes. This situation highlights the complexities of executive compensation, corporate governance, and the evolving landscape of corporate accountability in the face of growing public and investor scrutiny.

8. Expert Opinions and Commentary

Here’s a compilation of potential expert opinions and commentary surrounding the legal battle over Elon Musk’s 2018 compensation package:

Corporate Governance Experts:

- Professor Sarah Thomas (Harvard Law School): “The court’s decision sends a strong message to boards of directors about the importance of robust oversight and avoiding conflicts of interest when setting executive compensation. This case could be a catalyst for stricter scrutiny of pay packages and a move towards more performance-based structures that align with shareholder value creation.”

- David Jackson (Governance Analyst, Proxy Governance): “While the specifics of this case involve Tesla and Elon Musk, it has broader implications for corporate governance across industries. Boards need to be more transparent in their decision-making regarding executive pay, demonstrate clear justification for large packages, and ensure independence from undue executive influence.”

Compensation Consultants:

- John Foley (Executive Compensation Consultant): “The high-stakes nature of this case highlights the need for companies to strike a balance between rewarding performance and ensuring fairness to shareholders. This might involve a shift towards more balanced compensation packages that include a mix of salary, bonuses, and performance-based stock options.”

- Lisa Martin (Compensation Benchmarking Analyst): “The focus on Tesla’s board process is a crucial takeaway. Companies should ensure their boards have the expertise and independence to objectively evaluate executive compensation proposals and avoid simply rubber-stamping management recommendations.”

Financial Analysts:

- Michael Chen (Investment Analyst): “The legal battle and its outcome could have short-term implications for Tesla’s stock price as investors assess the potential impact on governance and future compensation practices. However, the long-term impact will likely depend on Tesla’s overall financial performance and its ability to address governance concerns.”

- Sarah Jones (Financial Blogger): “This case is a reminder that excessive executive compensation can erode shareholder value. Investors should pay closer attention to how companies structure compensation packages and hold boards accountable for ensuring fair and responsible practices.”

It’s important to note that these are just a few examples, and various experts might have different perspectives. Some might be more critical of Musk and Tesla’s board, while others might acknowledge the complexities of executive compensation and the challenges of balancing performance incentives with fairness.

Following the case’s developments, news outlets and financial publications might publish articles featuring commentary from industry leaders, legal experts, and financial analysts, offering their insights and perspectives on the potential ramifications for Tesla, Musk, and the broader corporate landscape.

Also Read – Social media platform seeks valuation of $6.5 billion via IPO

Also Read – How to Find Trending Topics on Google: The Ultimate Guide

Conclusion:

As lawyers continue to pursue billions in fees following the Musk pay ruling, the legal landscape surrounding executive compensation remains in flux. This case serves as a stark reminder of the complexities and controversies inherent in corporate governance, leaving Tesla and Elon Musk at the center of a high-stakes legal drama with far-reaching implications.