Twitter is one of the most influential social media platforms in the world, used by millions to connect and share ideas. But as a publicly traded company, Twitter is also analyzed by its market capitalization – the total market value of its outstanding shares.

So, what exactly is Twitter’s market capitalization, and how does it reflect the company’s overall value and performance? This comprehensive guide will break down everything you need to know about Twitter’s past, Twitter present, and future Twitter’s market capitalization.

Table of Contents

Introduction to Twitter’s Market Capitalization

Before diving into the specifics of Twitter’s market cap, let’s review some key investing basics. Market capitalization (market cap) is a company’s total market value. It is calculated by multiplying the current stock price by the total number of outstanding shares.

This metric gives investors a quick way to assess the total market value of a public company like Twitter. Market cap indicates the public consensus on the company’s net worth and can fluctuate daily as stock prices shift.

It is a key factor investors consider when analyzing and valuing stocks. Other relevant variables like revenue, profitability, and growth prospects also impact a stock’s value, but the market cap is a core piece of the puzzle.

Now that we’ve defined market capitalization let’s analyze Twitter’s specific market cap over the years since it went public in 2013 up to the present day.

Twitter’s Market Cap History

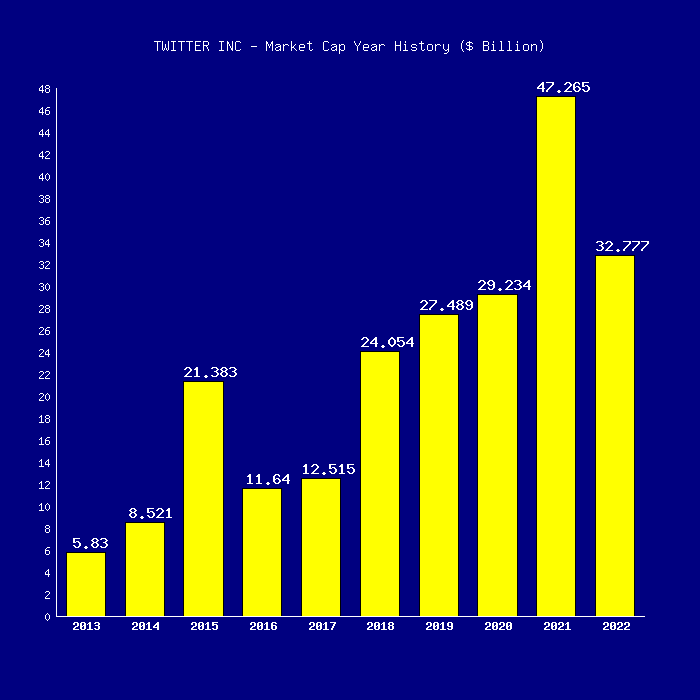

Since its initial public offering (IPO) in November 2013, Twitter’s market valuation has been on a rollercoaster ride, with plenty of peaks and valleys along the way. Let’s look at the key events impacting Twitter’s market capitalization over time.

Twitter IPO in 2013

When Twitter made its stock market debut on November 7, 2013, it set an IPO price of $26 per share. At the end of the first day of trading, the stock closed at $44.90 with a market cap of over $31 billion.

2014-2016: Early Growth Phase

In 2014 and 2015, Twitter’s market cap fluctuated in the $20-$30 billion range as investors debated the platform’s growth potential. By 2016, revenue growth was accelerating, and Twitter’s market cap reached upwards of $16 billion.

2017-2018: Stagnation Phase

Investor confidence in Twitter declined in 2017 and 2018 as monthly active user (MAU) growth stalled. The stock price traded sideways, and Twitter’s market capitalization remained around $20-$25 billion.

2019: Major Upswing

Twitter made a huge market cap comeback in 2019, adding millions of users and launching new ad products. The stock soared, at times exceeding $40, boosting Twitter’s valuation to nearly $30 billion.

2020-2021: Pandemic Surge

The COVID-19 pandemic further fueled Twitter’s growth as people turned to the platform for real-time updates. Twitter’s market cap shot past $40 billion in early 2021 off revenue growth before cooling later that year.

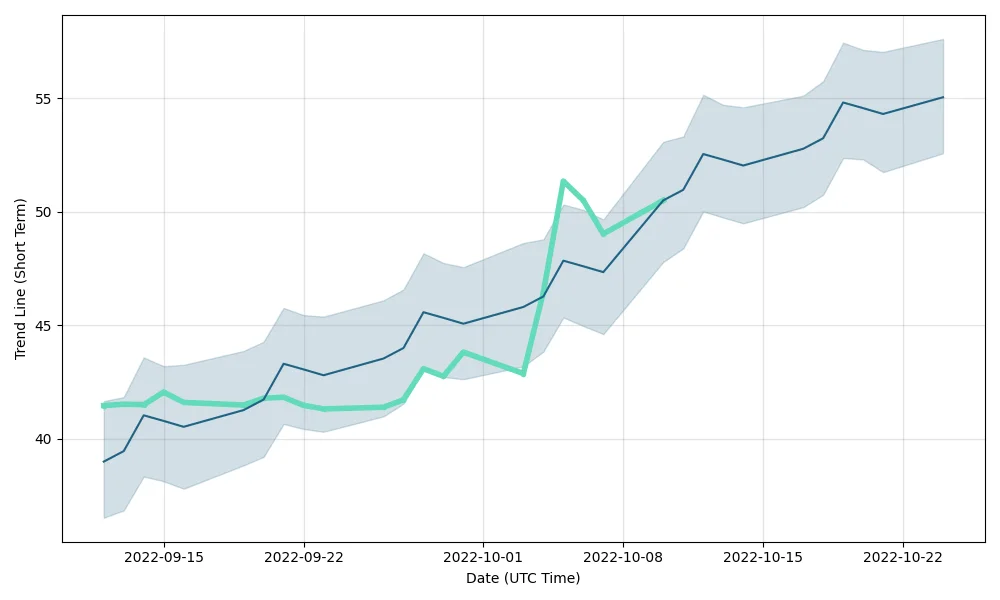

2022: Elon Musk Takeover Drama

Twitter agreed to be taken private by Elon Musk in April 2022 at $54.20 per share, valuing Twitter at around $44 billion. However, market chaos ensued during their legal battle before the acquisition finally closed in late October 2022.

Now that we’ve covered the major events shaping Twitter’s market capitalization history let’s analyze its current market value.

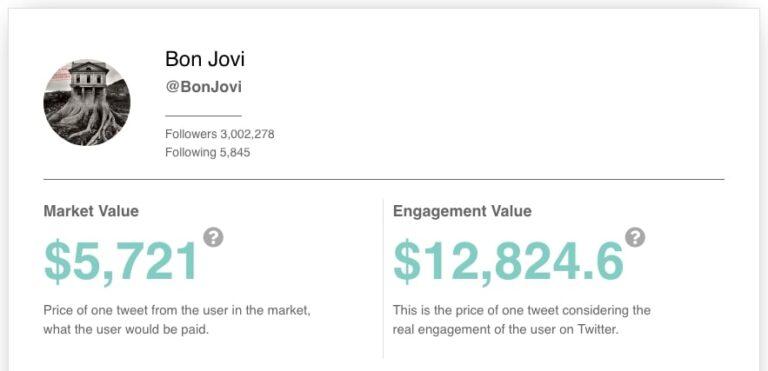

Also read: How Much is Your Twitter Account Worth? Valuing and Selling Your Twitter Profile

Twitter’s Current Market Capitalization

As of October 2022, in the wake of Elon Musk’s contentious $44 billion takeover, Twitter’s market cap sits at around $25 billion. Here’s a closer look at factors impacting the company’s latest valuation:

Share Price

In the lead-up to Musk’s takeover, Twitter’s NYSE share price sank to around $38. As the acquisition saga continued, the stock traded under $50 before being taken private.

Number of Shares

Twitter had approximately 785 million shares outstanding before the buyout. The number of shares helps determine the overall market cap.

Market Volatility

Broader stock market swings, economic uncertainty, and tech industry volatility contributed to fluctuations in Twitter’s valuation amid the buyout.

Acquisition Discount

Being taken private meant Twitter stock would trade at a discount to full market value. The final $44 billion price tag was lower than earlier 2022 highs.

Advertiser Uncertainty

Some major advertisers paused spending surrounding the acquisition, raising questions about Twitter’s core revenue stream.

This combination of factors impacted Twitter’s market cap leading up to and following Musk’s takeover. Now, let’s look at…

What Drives Twitter’s Market Capitalization

Like any public company, Twitter’s market capitalization is influenced by a variety of internal and external forces that shape investor perceptions. Key drivers include:

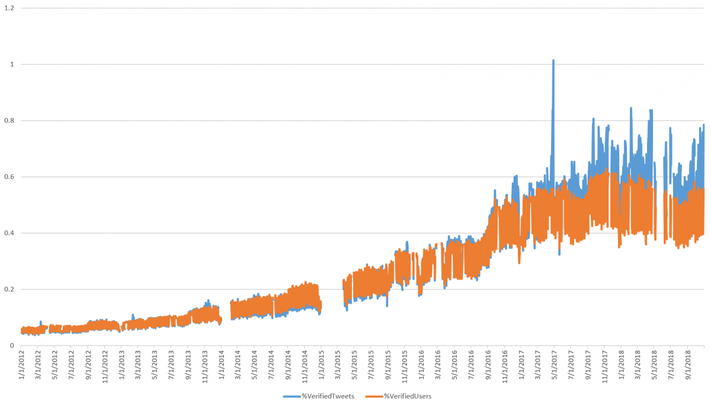

User Growth –

If monthly active users and daily visitors expand, it signals strong consumer demand, boosting Twitter’s market value. Stalled user growth can conversely deflate market cap.

Revenue Growth –

Strong gains in Twitter’s annual revenue through advertising, data licensing, and subscriptions improve market cap as profitability rises. Weak revenue drags down market value.

Profit Margins –

If Twitter’s net income rises as a percentage of revenue, it tells investors the company is efficiently profitable, enhancing its market cap. Declining margins indicate problems.

Product Innovation –

New product features like live audio spaces, newsletters, and profile NFTs that excite users also excite investors, potentially lifting Twitter’s market valuation.

Competition –

Threats from rivals like TikTok splintering users’ attention can undermine investor confidence and weigh on Twitter’s market capitalization.

Leadership Changes –

New Twitter CEOs, board members, and influential shareholders like Elon Musk spark market cap fluctuations depending on investor reactions.

These and other core factors above impact analysts’ projections of Twitter’s future earnings potential, influencing share prices and market cap.

Is Twitter’s Current Valuation Undervalued or Overvalued?

At around a $25 billion market cap presently, is Twitter’s valuation justified, or does it have more room to grow or fall? Evaluating whether a stock is undervalued or overvalued relative to market cap is subjective, but here are arguments on both sides:

Undervalued Case

Some investors argue Twitter remains undervalued for reasons such as:

- Trades at low P/E multiple relative to peers

- Has the potential to monetize users more with subscriptions

- Valuable real-time news and data value not fully captured

- Musk takeover unlocks entrepreneurial potential

Overvalued Case

Others insist Twitter is currently overvalued because:

- Ad spending is vulnerable to economic downturns

- User growth challenges not fully resolved

- Faces rising competition for attention from TikTok, etc.

- Uncertainty around Musk’s leadership and direction for Twitter

The bull vs bear debate around Twitter’s value continues as Musk aims to maximize profits. Time will tell whether Twitter is undervalued or overvalued in the market.

Factors That Could Increase Twitter’s Market Cap

For Twitter to significantly expand its $25 billion market capitalization, it would require boosting investor confidence through strategic moves such as:

Doubling Revenue –

Generating over $7 billion in annual revenue could double Twitter’s market cap projection by showing earnings power.

Unlocking New Revenue Streams –

Adding paid features or subscription services beyond ads would demonstrate untapped profit potential.

Accelerating User Growth –

Attracting 100+ million new active users would signal strong consumer enthusiasm for Twitter.

Maintaining 30%+ Profit Margins –

Keeping margins high while growing revenue would translate to major bottom-line gains.

Minimizing Threats –

Fending off competition from TikTok and the negatives of a recession would help Twitter beat forecasts.

Innovating Products –

Rolling out creative new ways for users to connect could re-energize Twitter’s platform value.

Effective Leadership –

Elon Musk reigniting Twitter culture and boosting staff morale could boost execution and market cap.

Scenarios Where Market Cap Could Decrease

On the flip side, Twitter’s market capitalization could certainly recede under scenarios like:

Declining Users and Engagement –

Losing active users or seeing less daily engagement would undermine perceived value.

Ad Revenue Slowdown –

Brands spending less on ads amid economic woes would directly cut revenue.

Failure to Monetize –

An inability to generate paid subscription revenue beyond ads would disappoint.

Competitive Pressures –

Losing more users and ad dollars to TikTok and Meta would signal competitive troubles.

Loss of Key Partners –

Media giants or data companies walking away would pose partnership problems.

Toxic Culture –

A good workplace culture and talent exodus under Musk could improve execution.

Mishandling Risks –

Misjudging free speech issues, regulations, hacks, or other risks could backfire badly.

Projecting Twitter’s Future Market Cap

Given the above factors that could push Twitter’s value up or down, what does the future potentially hold for the company’s market capitalization? Here are 3 hypothetical market cap scenarios for Twitter:

Bear Case – $15 billion

If user growth continues to stagnate, advertisers cut spending in a recession, and subscriptions fail to pick up the slack, Twitter could sink to a $15 billion market cap.

Base Case – $25 billion

If Twitter maintains its user base, moderately grows revenue despite economic challenges, and introduces some paid features, a $25 billion valuation seems reasonable.

Bull Case – $60+ billion

In an optimistic scenario where Twitter soars to over 500 million users, doubles revenue through creative efforts like subscriptions and is led effectively under Musk, Twitter could reach a $60+ billion market capitalization.

Conclusion

In summary, Twitter’s diverse market valuation over the years reflects the platform’s rollercoaster journey since its 2013 IPO. Recent turbulence has lowered its market cap to around $25 billion.

But depending on the factors covered here, like user and revenue growth under unpredictable new owner Elon Musk, Twitter’s capitalization could fluctuate wildly, for better or worse. Its past and its future suggest one constant: expect the unexpected when it comes to Twitter’s market worth.